A recent deal we lost raised serious concerns about how far some brokers will go to push others out of the way, even using veiled threats of regulatory complaints. This story isn’t about winning or losing. It’s about what happens when industry professionals start exploiting policy quirks and trust gaps to gain an edge.

And no, I’m not calling for new rules or regulatory intervention. This one’s on us, the broker community.

The setup

We were working with a client on a 3-year fixed conventional mortgage. We secured an approval with a major bank at 3.94%; a competitive rate considering this particular offer doesn’t allow buydowns. The client was happy. Everything was progressing as expected.

Then the curve-ball came.

A few days later, the client said another broker had offered them a 3.89% rate. At the time, that rate didn’t exist in the broker channel. We suspected, and later confirmed, that the competing broker was using a portion of their commission to manufacture a lower effective rate.

We explained the mechanics to the client and offered to escalate the file internally to improve our offer. We were also good to offer cashback. But before the lender responded, the client asked us to cancel the file. We did so promptly.

The FSRA threat

Several hours after cancelling, we received a sharply worded email from the client demanding written confirmation. The message included this line:

“Please provide me with written confirmation that the application you submitted to The Bank on our behalf has been cancelled. Please note that if we do not receive this written confirmation within the next 48 hours then we will regrettably have no choice but to file a complaint with the regulator FSRA: Financial Services Regulatory Authority of Ontario.”

That wasn’t written by a client.

Borrowers don’t usually reference “FSRA” and “The Bank” in precise, broker-specific terms. (The Bank was named and goes by a name only used in the broker community) This was clearly drafted or coached by the competing broker, and it was obvious why.

Understanding the lender loophole

Some lenders only allow one broker to have a file in their system for a given borrower. Once a deal is submitted, no other broker can act on it unless the first file is cancelled.

That’s the system; and it works, most of the time.

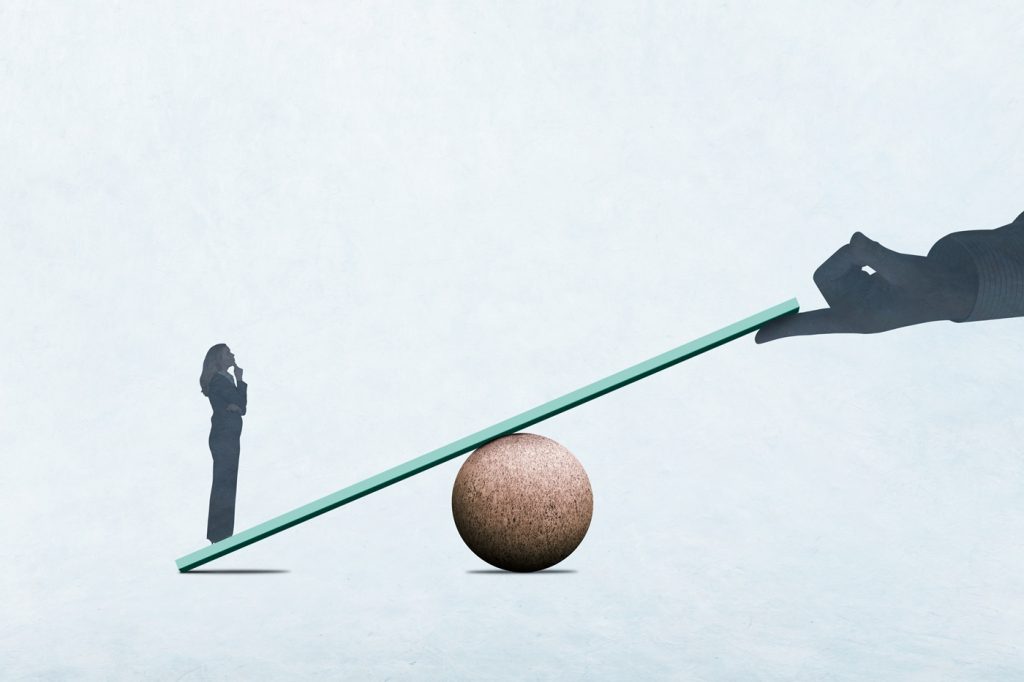

But in this case, the competing broker pushed the client to issue a regulatory threat, not to address wrongdoing, but simply to clear the field. Their offer wasn’t better; in fact, we later learned they were approved at 3.99%, higher than our approved offer.

The “3.89%” was smoke and mirrors, achieved by padding cashback into the deal, which we too were prepared to do.

Their strategy worked. The client aligned with the broker who floated the lower number first. Our escalation with the lender was moot.

What’s the real problem?

Losing a deal is part of the profession. No one funds every file. But when brokers start coaching clients to send threatening emails that reference regulators, just to push another broker aside, then in my view we’ve crossed a line.

This wasn’t about a client protecting their interests. This was about a broker using intimidation tactics that masquerade as compliance concerns.

It’s not illegal. It’s not even something FSRA would take action on. But it’s unprofessional. And corrosive.

A message to fellow brokers

To be clear: I’m not asking for new regulations. I’m not expecting lenders to overhaul their policies either. Lenders would rather lose one broker’s loyalty than lose the deal entirely.

This is an issue of professional standards, not policy.

So here’s what I think we, as brokers, can do better:

- Stop weaponizing compliance language. If you’re coaching clients to issue FSRA threats just to get a deal released, you’re misusing trust, and abusing the regulatory process.

- Be transparent about buydowns. If your offer relies on cashback to beat another rate, say so. Clients deserve to understand the full structure of their mortgage.

- Treat competitors like peers, not enemies. You don’t have to like losing, but you do have to act professionally. A quick phone call instead of a demand email can go a long way.

Why this matters, even if the client never notices

To the client, this was just “brokers fighting over my mortgage.” And they got their deal. The lender got the mortgage. No harm, no foul, right?

But internally, it’s a different story. What’s lost is another shred of professionalism, another bit of goodwill among peers. If left unchecked, these tactics chip away at the credibility we’ve all spent years building in the broker channel.

In the U.K., this wouldn’t happen. Everyone, broker or branch, works off the same rate sheet. Cashback and buydowns are off the table. Business is won based on service, execution, and advice, and not with pricing gimmicks.

Final word

I’m not naming names. I’m not crying foul. But I am confident that this was one of many instances where the competing broker used this strategy to win business away from other mortgage brokers.

And I am saying this: if brokers keep using regulatory threats and opaque pricing tactics to edge each other out, we all lose in the long run. We lose the respect that should come with calling ourselves professionals.

This isn’t a policy problem. It’s a people problem.

And it’s one we can fix if we want to.

Opinion pieces and the views expressed within are those of respective contributors and do not necessarily represent the views of the publisher and its affiliates.

Visited 547 times, 547 visit(s) today

brokers competition fsra mortgage broker mortgage broker community opinion ross taylor

Last modified: October 15, 2025